Practically speaking, November is the first full month of the holiday season.

What commences with candy and costumes on the last night of October concludes with confetti and champagne corks on New Year's Eve.

No coincidence, then, that November also marks the beginning of serious holiday sales and specials.

"Half of the world of retail is on sale in November, whether it's a 20 percent markdown or 40 percent," says Daniel Butler, vice president of retail operations for the National Retail Federation. "It's a very heavy promotional month."

And November also hosts two of the most highly anticipated shopping days on the annual calendar: Black Friday and Cyber Monday.

This year, small and independent retailers are focusing on the weekend in between the two -- offering special sales, deals and buys. "And I think you'll see that trend grow," Butler says.

Want to get a good deal in November? Here are seven items where you're likely to find some good buys.

TVs and DVDs

If you're in the market for a TV or DVDs, November might just be your month, says Augie Grant, professor at the University of South Carolina and editor of "Communication Technology and Fundamentals."

There are going to be big specials coming on televisions, especially large screens and 3-D TVs, which have not been selling as well as expected, says Grant.

"As we get closer to Christmas, the prices are going to get better and better," he says.

You could save at least 10 percent to 20 percent, Grant says. Look for items such as a fairly simple 32-inch TV (without Internet capabilities or a half-dozen HDMI connections) for less than $250 during November.

"The cheapest time to buy a TV is November and December," Grant says.

You'll find some deals on DVDs, too. With the surging popularity of Blu-ray, movie companies are discounting their traditional-format DVDs to entice buyers and collectors, Grant says.

Look for a lot of popular movies for $5 to $10 during November, with some after-Thanksgiving sales with prices as low as $2 or $3, he says.

Also on the sale table this month: electronic tablets.

As a host of them are introduced to the market, their prices are how they fight for space on the shelves, says Grant. So prices drop.

With the exception of Apple, you can expect to find a selection of tablets in the $200 to $400 range in the stores this month, he says.

Winter Clothing and 2011 Collectibles

Look for markdowns on winter clothing staples such as gloves, hats and sleepwear, says Butler. "These are big items that are promoted in November," he says.

You can save 25 percent to 40 percent. "And that's in all size ranges," he says.

Also on sale: collectible items with the year "2011" on them, Butler says. With two months of the year left, retailers want to move them -- but discounts won't be as deep as what you'll see in December or January, he says.

"You get markdowns of about 20 percent, and you'll find more selection," Butler says.

Holiday ornaments, baby's first Christmas items, and "collectible china or anything with the year on it" are on sale, he says.

Halloween Costumes, Decorations and Candy

Small and independent retailers typically put holiday items on sale after the holidays -- which means anything targeted to October or Halloween will likely carry a deep discount in those stores during the first few days of November, says Carol Schroeder, co-owner of Orange Tree Imports in Madison, Wis., and author of "Specialty Shop Retailing: Everything You Need to Know to Run Your Own Store."

Look for deals on October and Halloween "home decor and things for the dress-up box," Schroeder says.

"Even if the kids don't know what they want to be next Halloween, you can always use some capes and hats for the dressing up in between," she says.

You can expect savings of 40 percent to 50 percent, Schroeder says.

But you have to move fast. Often independent shops can keep this stuff on the shelves only for a few days to the first week of the month, she says.

Halloween candy is on sale at retailers big and small. So if you can use Halloween candy in your holiday baking or for lunchbox treats, it's a good time to buy. And candy corn is just as appropriate for Thanksgiving festivities, she says.

You stand to save "60 percent off, at least," because stores aren't going to carry it over for next year, Schroeder says.

Outdoor Living Items

Remember that fire pit or outdoor living set you really wanted a few months ago? Pick it up now, and you can really get a bargain, says P. Allen Smith, author of "Living in the Garden Home" and host of "P. Allen Smith Gardens."

On items like fire pits and chimeneas (those short, freestanding pottery chimneys with bulbous bases), you could see prices slashed 30 percent to 50 percent, he says.

And other items, such as sling furniture, patio umbrellas, tiki torches, grills and grilling equipment, retailers will "just keep marking them down until they're gone," Smith says.

Big-box retailers are clearing out the summer merchandise and making room for the holiday items, he says. So when it comes to summer merchandise, "they want it gone."

Flower bulbs are another find. Look for discounts of up to 50 percent off, says Smith.

The Stars of the T-Day Table: Turkey and Potatoes

If you're serving turkey for any of your winter holiday festivities, November could well be the best time to buy it, says Chef Frank Terranova, associate instructor at Johnson & Wales University.

This month, look for brand-name frozen birds to sport price tags averaging from 59 cents to 66 cents a pound, he says. For special varieties and heritage birds, you could pay up to $3 a pound, he says.

But after Thanksgiving, expect to see the price of turkey increase 20 cents to 25 cents per pound, Terranova says. So if you plan turkey for any December celebrations or inexpensive meals, it might be "smart to buy that turkey now," he says.

Potatoes and sweet potatoes are another good buy. "They had a good crop this year," Terranova says. And sweet potatoes and Yukon Gold, in particular, "are going to be an exceptional buy," he says.

For both potatoes and sweet potatoes, look for prices that average about $2.40 for a 5-pound bag, Terranova says.

Apples and Squash

Good harvests for some of the root vegetables mean great prices for consumers this month, Terranova says.

Above the ground, apples are a popular pick. "Apples are off the hook," he says.

While Terranova's picking them up for $15 for 15 pounds, not everyone wants to buy bulk.

In smaller quantities, prices are averaging around $1.20 to $1.30 a pound for domestic varieties of apples, while Galas and imports sell for closer to $2 per pound, he says.

And that's a cut of 10 cents to 15 cents a pound from last year, Terranova says.

Another great buy this month is squash.

"One of the biggest things today and most flavorful: butternut squash," Terranova says. "And it's an economical buy." Acorn squash is tasty and affordable, too.

Squash is in season, popular at the Thanksgiving table and about 15 cents per pound cheaper this month, he says.

Don't be afraid to get creative with some of the traditional fall favorites, Terranova says.

With a recent abundance of pumpkins, his students found a great way to prepare them: cut up and broiled, then tossed with heavy cream and some sage to serve over pasta.

The result, says Terranova, was something unconventional and delicious.

This article is part of a series related to being

Financially Fit.

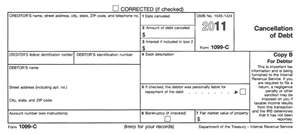

WASHINGTON — In an annual reminder to taxpayers, the Internal Revenue Service announced today that it is looking to return $153.3 million in undelivered tax refund checks. In all, 99,123 taxpayers are due refund checks this year that could not be delivered because of mailing address errors.

WASHINGTON — In an annual reminder to taxpayers, the Internal Revenue Service announced today that it is looking to return $153.3 million in undelivered tax refund checks. In all, 99,123 taxpayers are due refund checks this year that could not be delivered because of mailing address errors.