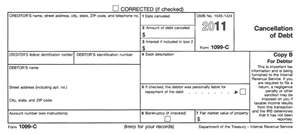

The IRS form 1099 is used by various entities to report income that they have perceived you have earned. Example: Big Bank issues you a credit card. You run up $2,000 and never pay. After some time Big Bank will issue a 1099 to you. They are also reporting the $2000 as income you have earned, to the IRS. A 1099 can be a blessing because no one else can come after you for the $2,000, the bad side is that now you may have to pay income tax on the $2000.

The IRS requires financial institutions to report to them the amount of principal they charge-off for individual borrowers. It is only to be filed after you have stopped collection activity and there has been no payment activity on the account for three years. This is not a way for financial institutions to try and collect further. It is an added burden on them to track these conditions and find the records when they meet the criteria for filling. The financial institution had written the debt off years earlier.

More information for consumers

If you're receiving one of these, the most common reason is consumer debt, credit cards--banks may also issue 1099-c forms for mortgages,

1.) You have a debt that was never paid, or partially paid, sold to a collection agency who still couldn't collect, etc. Whatever the point is, whoever owns the debt is writing it off as a loss. This is not very common because unless you file for bankruptcy, most collection agencies or banks won't simply "give up" on you. If anything, they'll file for a judgment against you for the debt, interest, collection costs, capitalization fees, etc. It is very unlikely that you're receiving a 1099-C simply because the bank said "ah, lets write this one off." With the problems lenders are having these days, no bank is going to surrender debt as a loss. or,The IRS requires financial institutions to report to them the amount of principal they charge-off for individual borrowers. It is only to be filed after you have stopped collection activity and there has been no payment activity on the account for three years. This is not a way for financial institutions to try and collect further. It is an added burden on them to track these conditions and find the records when they meet the criteria for filling. The financial institution had written the debt off years earlier.

More information for consumers

If you're receiving one of these, the most common reason is consumer debt, credit cards--banks may also issue 1099-c forms for mortgages,

2.) You had a collection agency or bank hounding you for money. Hopefully you were smart enough to pay them off with a lump sum instead of making payments that merely cover the interest. Anyway, if you were even smarter, you realized that the principal of the original debt (say it was a $5,000 credit card) was like 33% of the amount they were now demanding, and you cut a "deal" to close the case. Well, say it was a $5,000 credit card, they were demanding $13,500, and you gave them $10,000 to call it even. Well, the difference between the "demand" and your "settlement" is considered taxable income by the government. You have to pay income taxes on that $3,500 that you "gained."

Please note--some exceptions do apply. Most commonly, if you were insolvent at the time of the settlement (not bankrupt, insolvent) meaning your current liabilities (loans, debts, bills, etc.) outweighed your assets (income, savings/checking accounts, other assets like house, car etc.) you do not have to pay the tax---the theory being that the debt was written off because you couldn't pay. You must file Form 982 and complete an insolvency worksheet. Be prepared to prove that you are in fact insolvent. IRS may ask for it.

IRS CIRCULAR 230 Disclosure:

Under U.S. Treasury Department regulations, we are required to inform you that, unless expressly indicated, any tax advice contained in this email, or any attachment hereto, is not intended or written, to be used, and may not be used to (a)avoid penalties imposed under the Internal Revenue Code (or applicable state or local tax law provisions) or (b)promote, market, or recommend to another party any tax-related matters addressed herein.

No comments:

Post a Comment